Influencing factors and opportunities for ESG in construction (Part 3)

The following excerpt is taken from our recent webinar on ESG. You can read part 1 (Shareholder activism) and part 2 (Modern slavery) – or watch the full webinar here.

Why construction needs to pay attention to ESG

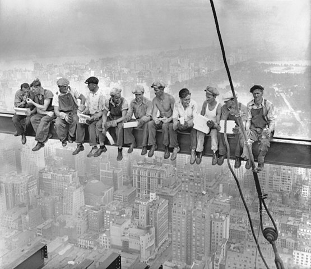

I wanted to start this with a very famous photograph. It's called ‘Lunch atop a skyscraper’.

It was taken on September 20, 1932, and it features 11 immigrant ironworkers sitting on a steel beam 260 metres above the ground - that's now the 69th floor of what is known as 30 Rockefeller Plaza in Manhattan, New York City.

Obviously, there are health and safety implications. This photograph though, was taken as a publicity stunt without any safety equipment at all and there were no records of anybody who was actually involved in the project.

I wanted to show you this because things have changed in the last 90 years. The industry has a massive opportunity to make a difference. It did it between 1932 and now in terms of workplace health and safety, and it can do it again in terms of ESG.

Stats show that 97% of infrastructure companies with core and non-core assets are exposed to ESG risks that have the potential to impact their credit ratings if those risks are not actively managed. (Linklaters, 2022).

Building and construction is responsible for around nearly 40% of carbon emissions globally, according to the Green Building Council. It’s also responsible for about 25% of global water usage and 40% of usage of global resources.

We have a massive potential for cutting emissions and reducing footprints. And that's with the technology that's available now.

Here's a scary statistic. Over 80% of the buildings that will be here in 2050 when we have committed as a country to net zero have already been constructed. In other words, the effect of those buildings will be felt in a future with unknown weather conditions and perhaps scarce resources. We need to be focusing on this issue.

Health and safety

Workplace health and safety has come a long way since the Rockefeller Plaza picture was taken.

Zero harm is one thing, and we know that the industry is very good at complying with the workplace health and safety regulations, but how is the rise of ESG going to affect your business?

In the last few years, mental health and well-being risks have increased significantly. They have become one of the most prevalent causes of illness and injury within the industry.

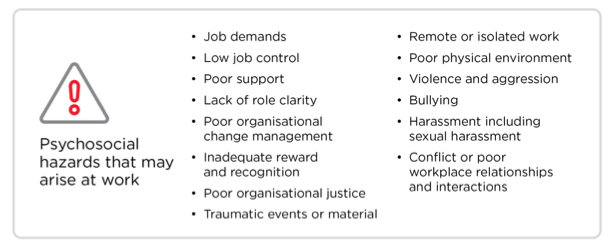

The advice that I would suggest is management of psychosocial hazards should take a similar approach to other health and safety risks on site.

In other words, use a risk management approach and consider things like what are the demands of the job; how much control does the individual have in that job; whether there's good support, poor support; poor reward, and recognition – and so on.

In the last few months, Safe Work Australia has published its finalised national model code of practice for managing psychosocial hazards at work. It's been called the “Employer's guide to the risks you can't see”. It's approved in Queensland, and it's been adopted expressly in New South Wales.

Source: Safe Work Australia

Source: Safe Work Australia

In NSW, there's now an explicit requirement for a person conducting a business or undertaking - which is most infrastructure companies - to manage psychosocial risks in the workplace and implement control measures to minimise, if not eliminate those risks. Now that safety legislation has been changed in NSW since 1st October this year, you need to get your head around this.

Firms in Australia arguably are a little bit behind the curve in terms of dealing with health and safety risks and ESG.

Looking at what's happening in Europe and the UK and to some extent the States, they're taking a very different approach in overall well-being.

One example that can influence the supply chain is to reduce the use of “gig-economy” contracts because that provides more certainty in terms of work hours, which avoids worker exhaustion from long hours.

Some projects have even installed GP practices and well-being centres on site. A more common approach is that canteens on site provide healthier food options, which aims to encourage workers to eat less convenience foods and hopefully foster a sense of community among the workforce.

Firms are now expected to manage well-being as they do other more traditional health and safety risks. If you're not certain that you're covering this, then I would suggest you need to conduct a risk assessment and get the necessary advisors, and if that's what it requires.

Risk and innovation

The evolution of the industry at all levels is going to be necessary if we want to make the most of the ESG opportunities presented to us and avoid the pitfalls.

Meaningful ESG-related innovations and improvements are most effective when they're developed or implemented in the early phases of project planning.

I'm going to suggest that it's likely that project planning - early phases - will take longer, and they're going to require new capabilities, possibly more resources.

Many construction companies are already using ‘carbon tools’ within their Environmental Impact Assessments to measure carbon emissions across project delivery, including the use of plant, transportation methods, welfare facilities and the sourcing and delivery of materials.

These carbon tools and the increased use of digital twins and scenario modeling at scale can help determine the effect of different decarbonisation solutions on ESG results, and choose optimal green solutions.

However, those of you running construction businesses, you will support that all of those things come at a cost.

So let's talk money

The important bit in many respects is how we are going to pay for this.

We know that the construction industry certainly and the infrastructure industry to an extent. Both have been running on very thin margins now for quite a while.

There is thought leadership out there that suggests the marketplace has to accept that traditional race to the bottom mentality does not go hand in hand with sustainability. That's a massive understatement.

All of this ESG transfer is going to cost money.

However, ESG could be the disease and the cure at the same time for our industry.

For example, infrastructure funds tend to have long term investment horizons, and they're in a unique position to work with management and embed ESG values into the company culture. Many funds now incentivise management to facilitate this implementation.

Further, banks and credit agencies are increasingly taking ESG factors into consideration in their credit ratings and loan covenants. It's important to understand how these factors can impact on financing decisions regarding an investment. And then you would be able to use the knowledge to define action plans so you can manage your credit risks.

965e.png) (More ESG stats here)

(More ESG stats here)

Investors are also taking a much more holistic approach, and they're looking at the purpose and impact of investments for wider society. This is going to affect all of us because we all need to contribute to that process purely in terms of providing information. The challenge then is to reflect it properly into the contract documentation.

Opportunities

Because the money is following the ESG, there's going to be some benefit for companies in adopting ESG principles.

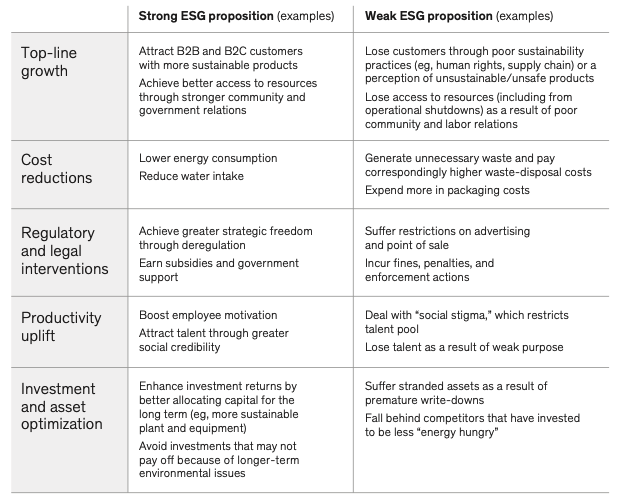

McKinsey recently reported the ESG links to cash flow in five different ways. It facilitates top line growth, it reduces costs, minimises regulatory and legal interventions, increases employee productivity and optimises investment in capital expenditures.

Source: McKinsey

Source: McKinsey

So what are the opportunities?

If you embed ESG process early in your project, you can stand out from the crowd.

If you embed ESG process early in your project, you can stand out from the crowd.

There's a lot of government projects, at all levels of government, that you cannot bid for unless your house is in order. In other words, you have to comply with ESG requirements so that you can unlock and win projects. The good thing is that by doing that you can save operational costs.

For example, if you've thoroughly analysed your use of water across the site for the life of your construction project, even possibly for the operational life of your project, you can help minimise water consumption on that site and therefore reduces costs.

It can also help to attract and retain talent. The studies, to the extent they exist at this stage, are showing that millennials and Gen Z generations are placing larger importance on a company’s ESG program than former generations.

If you've got a good ESG program, you can build trust, you can increase productivity and you can help retain good staff, and that's an issue that's affecting all of us at the moment.

By tracking ESG issues and reporting on them, you can uncover risks that impact profitability. For example, organisational risk like staff turnover.

Waste management's another opportunity, and one that I'm very interested in. We can prevent tonnes and tonnes and tonnes - of construction waste being put into landfills.

We can even, in some cases, find alternative uses for that construction waste, which become new revenue streams and the potential there is massive.

We've also talked in terms of ESG improving employee safety. The Internet of Things, sensors in some sites have been installed to allow for real time monitoring of job site conditions - now that's brand new and has to improve safety.

Education is another benefit. There are companies out there that have long standing programs and associations aimed at minority and women-owned businesses so that they can diversify and include more people. That's been shown time and again to improve reputation and your bottom line.

-----

If those are the opportunities, what's next? Stay tuned for the next part where we’ll discuss regulatory trends on the horizon and tips to get ready.

----

Watch the full ESG webinar here.

Related Articles

Using Felix to store contracts - a holistic view of vendor relationships

You’ve found a vendor to engage, the Recommendation for Award has been created and approved (using Felix Vendor Management), and your organisation can successfully start the business relationship once the contract is signed.

The 3 types of procurement technology adopters: which category do you fall into?

What’s your relationship with procurement technology? Does your organisation trial and error the full breadth of the market, or is any new software implementation a multi-year process?

Let's stay in touch

Get the monthly dose of supply chain, procurement and technology insights with the Felix newsletter.