Following from the previous post, we can see that ASIC is getting serious about ESG. It's identified greenwashing as an enforcement priority.

If you got a net zero projection, you got to be able to say how you will get there. You need a plan.

You need to show at the time that you made your claim you've got reasonable grounds for making it. You have clearly documented strategies for implementing it, and the ability to achieve the commitment in practice. Otherwise, you're risking potentially serious reputational damage because it could be misleading and deceptive conduct.

All of what we've talked about is dependent on being able to gather specific data about your business and also dependent on the standards that you have to report against.

You can watch the full webinar on ESG here

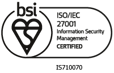

What standards do we have to report against?

We're looking at the ISSB Sustainability Disclosure Standards in Australia. This is built on work by international standards agencies and Australia is looking at adopting these standards or something quite similar to them. It’s not expected that international standards for reporting will be finalised until early next year and the Australian ones might take a little bit longer than that.

Goals, Reporting and Regulations Pyramid. Source: Rabobank

This is a state of flux, so in the meantime, how do you comply?

In Australia, we've got mandatory reporting in respect to modern slavery and also a Workplace Gender Equality Act. For certain issues or financial products, there are some mandatory reporting requirements under the Corporations Act, but the long and the short of it is that mandatory reporting on everything ESG in its entirety is quite likely to be brought in here.

Climate- related financial disclosures are mandatory in the UK and in the US for companies over a certain size. New Zealand and European Union got similar requirements, and Singapore and Hong Kong stock exchanges are both moving to mandatory disclosures on ESG for listed issuers.

Interestingly, nearly 3/4 of the ASX200 now report to investors on managing ESG issues - 2/3 of ASX200 report ESG compliance against UN’s Sustainable Development Goals. It's a mixture of standards they're reporting against, but at least they are now reporting.

Although what I found quite surprising - and in some respects, shocking given that I've just finished my AICD Company Directors course - that this year, PwC reported it found 75% of the ASX200 companies do not have a board member with any climate competencies whatsoever.

I think that has to change. Mandatory climate reporting is expected to be a focus of the Albanese Federal Government, and we've got to start thinking about it.

Lawsuit examples

Here are a couple of quick examples as to why you need to be thinking about this.

ESG strategic litigation is going to continue. Groups are well organised and funded, and they're not scared of a fight these days.

Santos

In late September, the Tiwi Islanders off the North Coast of the Northern Territories won a landmark case against Santos.

Santos wanted to drill in the Tiwi Islands traditional waters and the Islanders complained to the offshore oil and gas regulator Nopsema that they hadn't been consulted about the project’s impact. Nopsema failed to assess whether Santos had consulted with everyone affected by the proposed drilling.

There's no evidence that Nopsema, or to some extent Santos, understood that the Tiwi Islanders really needed to be consulted. And to be fair to Santos, I think Santos had done what a lot of us might have done - they'd send a consultation package, they'd send an email and they tried to reach people by phone.

Source: Getty, SMH

They hadn’t got a response - it all got too hard and they didn't pursue it. The judge said that should have told them something. The judge set aside approval for drilling, which is part of Santos’ $4.7 billion Barossa project. He [the judge] gave Santos two weeks to shut down and remove the rig from the sea, north of Melville island.

Even though we know that Santos was appealing that decision (and have lost), its operations have been severely affected and it will have incurred a lot of cost all because, effectively, there's a new standard set about the depth of consultation.

You must not only make genuine efforts to consult with everyone whose interests are affected, but you also have to demonstrate clearly how those people were identified. And that means that your consultation plans must be strategically assessed at an early stage, if not, you can find yourself explaining to your boss why your drilling operation has to stop work or move temporarily.

Star Entertainment

This is really a governance case. We've seen what's happened in Star Entertainment, and we know that they lost their New South Wales casino license effectively due to money laundering and not controlling that risk. It sounds like their involvement in Queens Wharf in Brisbane is certainly under scrutiny and they've just been fined $120 million in Victoria as well.

A lot of Star Entertainment’s problems were occurring at a time Crown Casino was already under scrutiny, and it was all over the media. The thing was that the board didn't seem to follow up on issues that it knew or should have known existed at the time.

The regulators have described this as a cavalier approach to governance, an absence of a culture of compliance which the enquiry said was absolutely notable.

Source: SMH

The consequences for Star have been very severe. Their reputation is obviously damaged, they've lost a considerable amount of money and they've had a clear out of touch board and management.

This is arguably due to failure to comply with law but, more importantly, boards need to take notice of that quote from the enquiry which said that your cavalier approach to governance is no longer effective. You need to know what you're doing and apply your governance knowledge.

How to get started

So how are you going to deal with all of this?

One of the things we need to do as an industry is change our mindset. This isn't just another one of those things we have to comply with.

This is something that we need to do for our planet, for our staff, for ourselves - but it needs a mindset change so that you can look at the risks and you can make the most of the opportunities.

You're going to need a multi-skilled team to pull your report together. It’s going to include people from finance, commercial, operations, procurement, and board oversight.

It really matters that you get the right team so that you can scope out what you need to do and make sure that you are giving enterprise-wide consideration to everything across your entire business function. That's going to include engaging consultants, perhaps to help with the legwork, and you're also going to need lawyers and accountants.

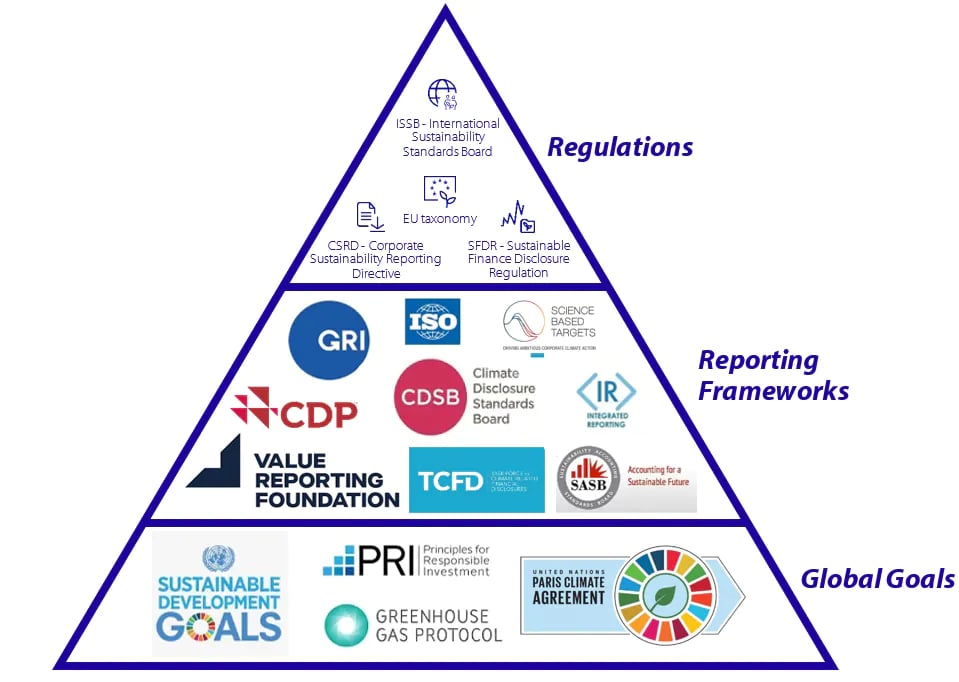

One of the things that I think really does help an organisation get from here to there - wherever there is - is an ESG road map.

I’ll give you an example from Stahl. Stahl is a world leader in leather chemicals and high-performance coatings, and they're based in the Netherlands. Their ESG road map is available online and it is quite good because:

- It's clear

- It sets the commitments

- It breaks down those commitments into areas

- It sets short- and long-term goals and KPIs

- It matches them, in this case, against the UN standards (not the ISSB ones that I was talking about earlier)

But it does mean that you match your standards and your goals, and you have a plan then for how you get to where it is you want to go on the ESG road.

Source: Stahl

A lot of what I've been talking about was data heavy. A lot of you have complex supply chains and you're going to have to report on them.

Obviously, doing your due diligence on your suppliers before they engage is going to be critical. You need to include ESG in your procurement requirements, scoring methodologies, for example, in your RFT assessment. You will also perhaps need to use some of your existing contractual rights and incentives like audit rights or good contract management being awarded, etc.

I think one of the key issues here though is how good your IT is. It's a massive job to look across your procurement chains if you're trying to do that on a manual basis. There are interesting IT solutions out there.

----

Felix CEO’s commentary

It's certainly an important strategic area for organisations to consider.

The clear positive out of all of this is the rate at which societies expectations are driving change in corporate behavior. The challenge for organisations is the sheer breadth of areas that ESG covers and what their obligations are, and I think to be able to keep their head above water in a really challenging operational environment.

The ability to streamline processes and create efficiencies to have transparency over their data, collate data from third parties in an efficient manner where required and provide really helpful reporting both externally and internally, is where organisations can look to technology to really do some of the heavy lifting on the manual processes that may exist with teams and stakeholders, and get them focusing on productive work rather than just the administration heavy lift.

Example of how tech can help with socially responsible procurement

--

A great point is that you don't want people spending time digging through documents and you want people out there doing the work that they're supposed to be doing and producing. And certainly, in terms of IT, a lot of the sophisticated entities have already invested in upgrades that can track supply chain issues.

Blockchains also being touted as a solution. To give you an example, Heineken recently used it to trace 5 hops varieties through their sourcing originals and captured the water and fuel consumption. It then was able to demonstrate each bottle’s environmental journey via a QR code on the bottle. You could argue “how many Heineken drinkers would be interested in that?”, but as an example of what can be done, it's pretty impressive.

Now those of you that are sitting there saying “yes, but IT is really expensive, and I don't have the capital to invest in that”. I know for a fact that you can get licensed software - you don't have to buy it, it's not a massive upfront capital expenditure - but that licensed software will help you track your supply chain issues. So, it's certainly something to think about.

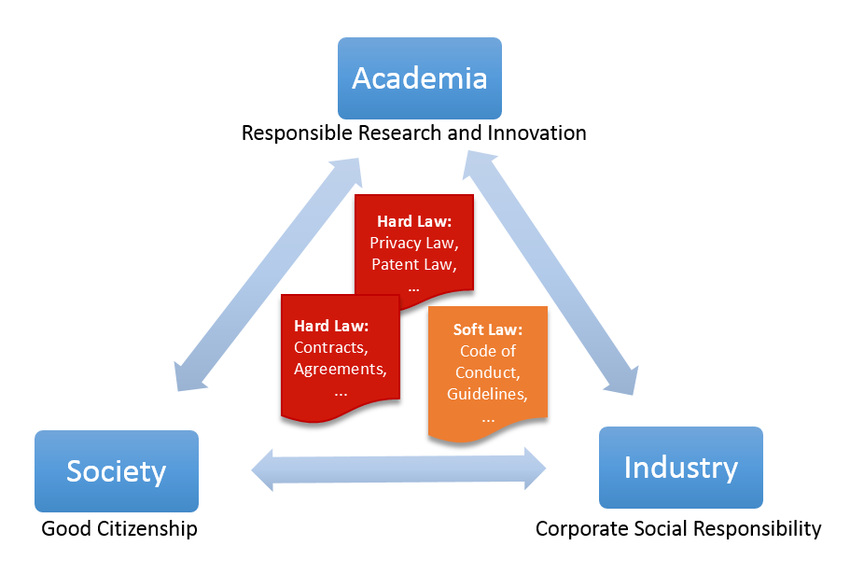

Soft law

Now the other thing to think about - a tip for the top in my book at least - is this idea of soft law. We're setting the bar here for stakeholder expectations, society’s expectations.

Hard law and soft law in the ecosystem. Source: ResearchGate

As previously mentioned with modern slavery, they haven't actually set penalties yet. What they're doing is allowing us to suffer the consequences by damaging reputation.

That soft law is a direct challenge for companies and boards, in particular, to do more than just comply with legislation. You need to up your game and look at maintaining suppliers and policies and all of these things in business that are consistent with your customers’ sustainable business practices generally.

Bring your subbies along by the way, it's always a good idea so that everybody is on the same journey.

---

Watch the full webinar on ESG here.

Related Articles

Using Felix to store contracts - a holistic view of vendor relationships

You’ve found a vendor to engage, the Recommendation for Award has been created and approved (using Felix Vendor Management), and your organisation can successfully start the business relationship once the contract is signed.

Why off-the-shelf procurement software trumps low/no-code systems for enterprise needs

In today's fast-paced business environment, procurement and vendor management play a critical role in optimising costs, streamlining processes, and mitigating risks. While low/no-code (L/NC) systems offer an attractive option for rapid development and customisation, they often fall short when addressing the complexities of enterprise-level procurement needs. Off-the-shelf Commercial Off-The-Shelf (COTS) software emerges as the more robust and reliable solution in the long run.

Felix is proud to announce SOC 2 certification and GDPR compliance.

In August 2023, Felix achieved SOC 2 Type 1 certification and GDPR compliance, an exciting moment for us as we continue to hold ourselves to the highest standards for data security.

Let's stay in touch

Get the monthly dose of supply chain, procurement and technology insights with the Felix newsletter.