We are living in an era where supply chains are becoming more complex. The ecosystem of a modern organisation has expanded to multiple tiers and layers.

As organisations become critically dependent on third parties to be profitable and deliver successful business outcomes, these third parties have become the Extended Enterprise.

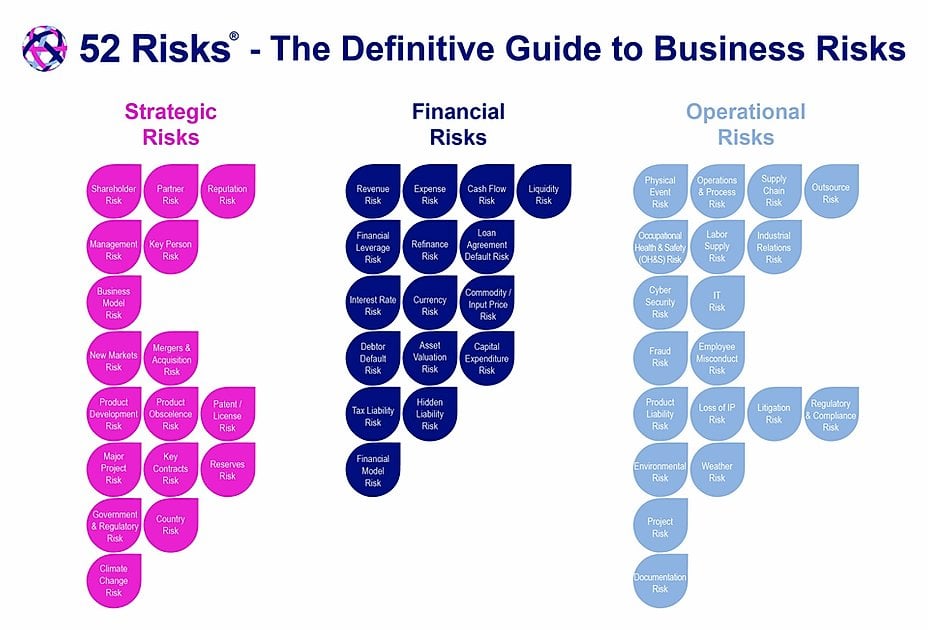

On top of that, increasing compliance requirements, compressed margins and the heightened complexity of projects is magnifying risk levels and exposure to Directors and senior executives.

Be the first to know when we launch the landmark research report Building in the Dark - High-risk Supply Chains: Attitudes, Responses & Opportunities.

More projects, more complexity, more risks

“Projects across Australia are getting larger and increasingly complex and will require new approaches if they are to be effectively delivered. So-called mega-projects – projects larger than $1 billion in value – are becoming the default, increasing the burden on the sector, and in some cases exceeding industry capacity.”

2019 Australian Infrastructure Audit

More recently, in The Grattan Institute has done a report called “The Rise of Megaprojects: Counting The Costs”, highlighting risks and cost blowouts.

Even before COVID-19 and the infrastructure-led recovery strategy was announced:

“The Prime Minister, federal Treasurer, and state infrastructure ministers were worried that there weren’t enough workers, materials, and machinery for the massive construction workload.”

The reality is that there are very few domestic construction companies with the size and experience to successfully deliver megaprojects.

“This means that some project owners are being forced to choose between paying more for a consortium of experienced local companies, taking a risk by accepting inexperienced players or bringing in foreign competitors; a difficult balance.”

Joint ventures, global partners working in Australia have to hire new supply chains on the fly - a ticking bomb of risks if not managed correctly.

It’s not only a matter of expertise that “forces” companies to engage third-party vendors, but also cost pressures.

“Many organisations feel significant pressure to save costs by continuing to outsource business activities, even when they have credible concerns about process failures or loss of control.”

The dance between cost and risk continues.

With the extended enterprise being effectively the organisation’s workforce, accountability has also been “extended”; from Industrial Manslaughter laws to newer legislations such as the Modern Slavery Act, Black Economy etc.

Over the years, the focus for third-party risk management has mainly been around the “largest regulatory issues of the year”.

And rightly so, as organisations that “have a good handle on their third-party business partners, can not only avoid the punitive costs and reputational damage, but stand to gain competitive advantage over their peers outperforming them by an additional 4-5% return on equity (ROE).”

That was pre-COVID.

When COVID-19 hit

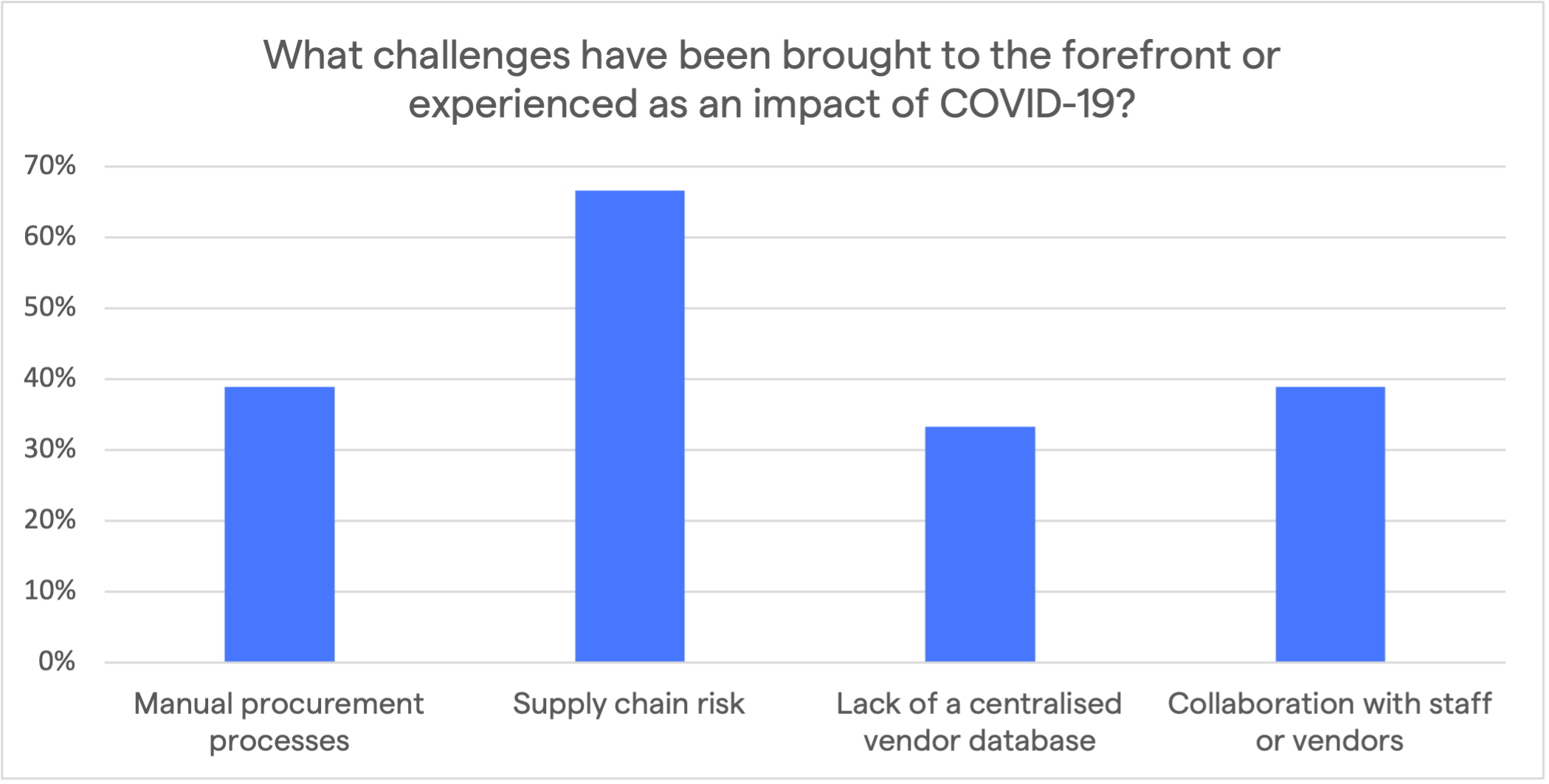

There was a raft of risks brought to the forefront. In our own quick survey last year, we asked our webinar participants these questions.

Business continuity and supply chain resilience were “back in fashion”.

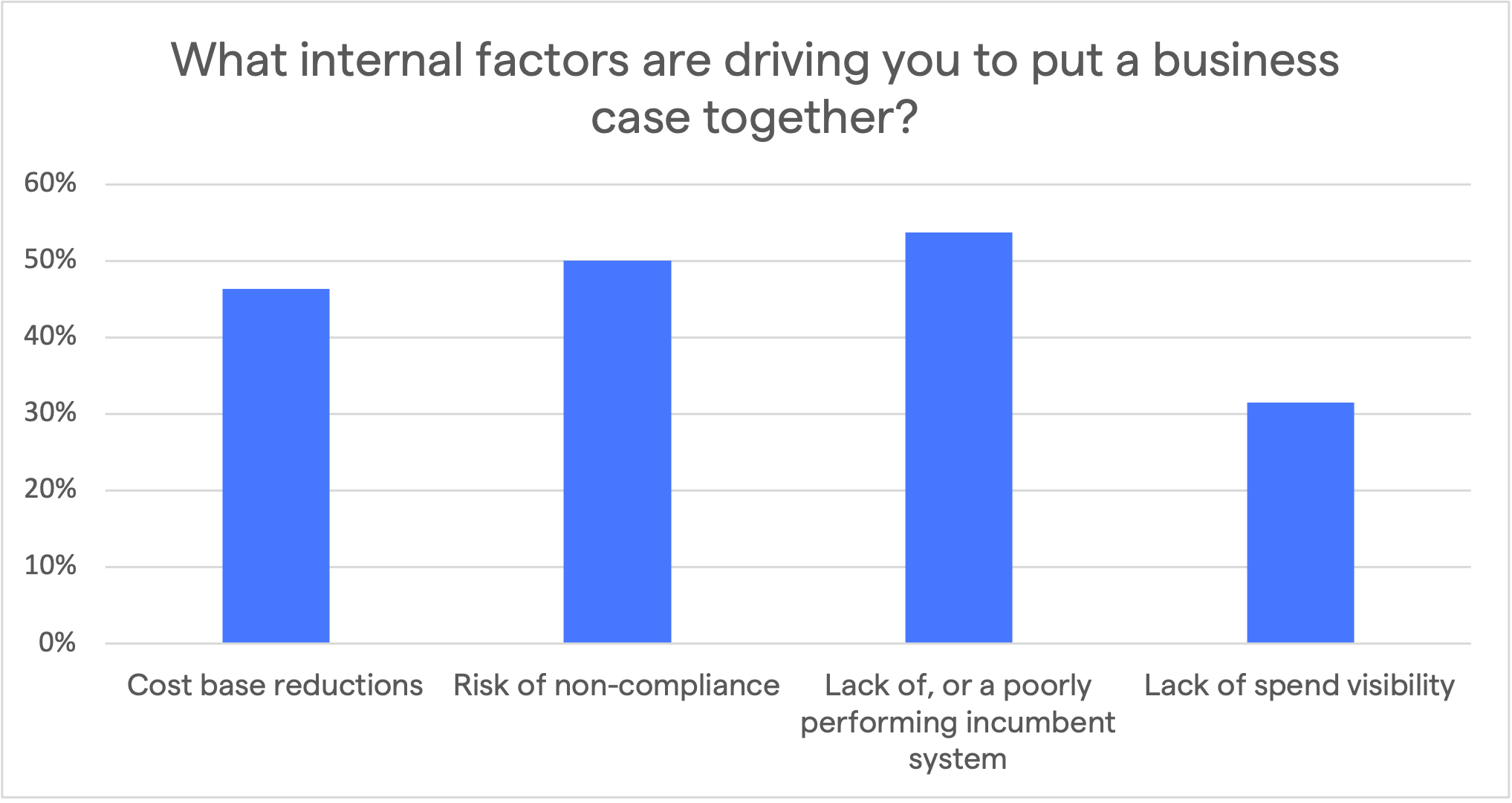

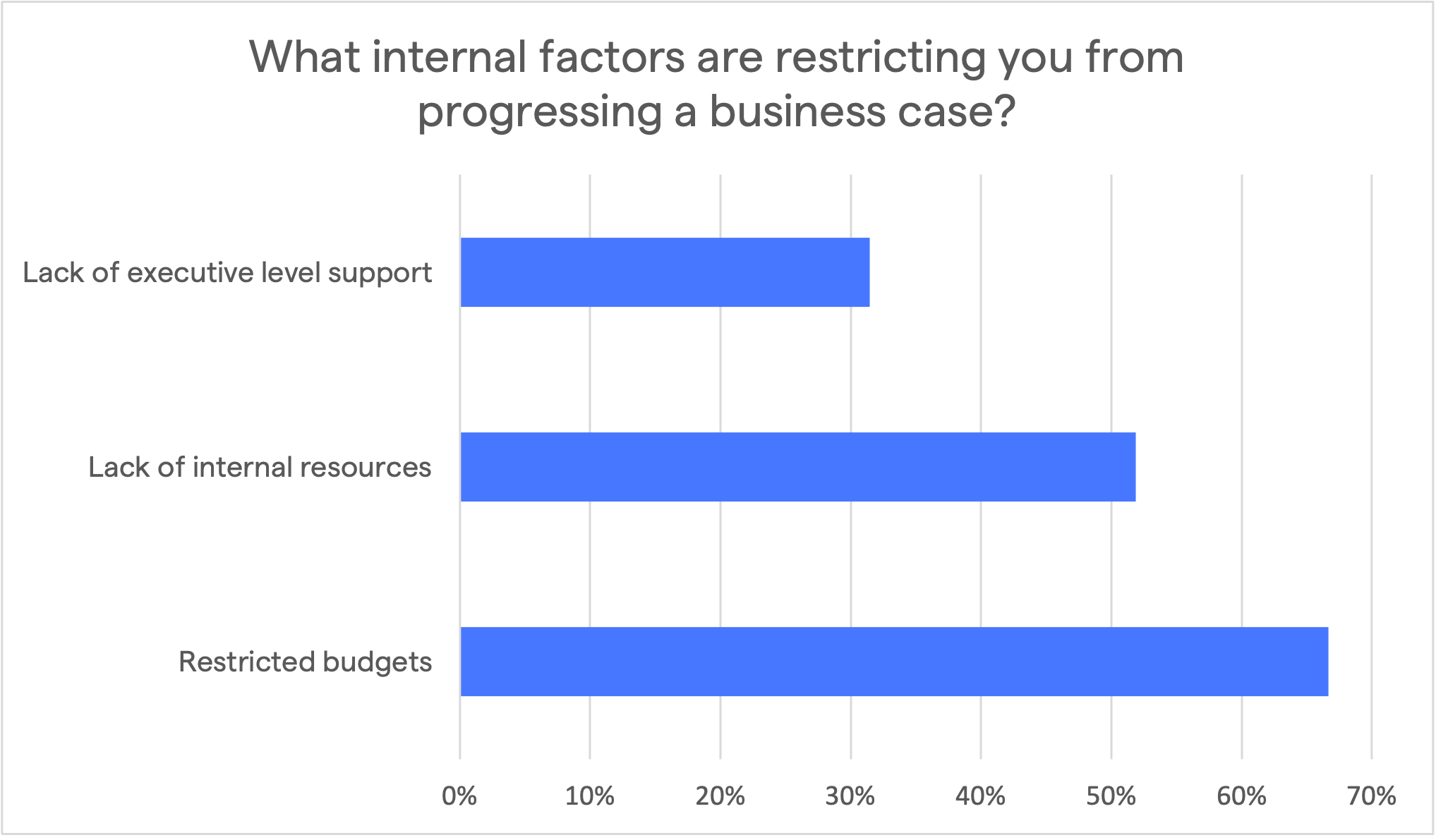

Undeniably, the acceleration of digitisation has also exposed some digital maturity gaps. Our survey participants, hence, were trying to put a business case for digital transformation….

…and ran into some challenges:

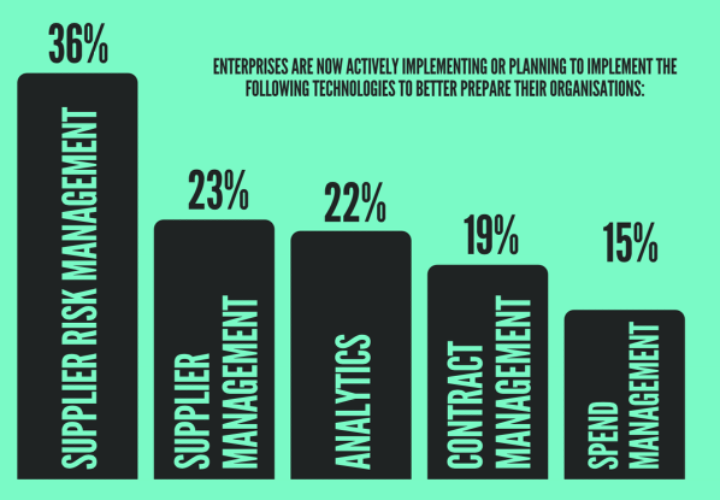

Curiously, Procurious in their Supply Chain Confidence Index 2020 research states that:

“From a procurement technology perspective, failing to invest in supplier risk and management technology pre-pandemic was the No.1 technology regret during COVID-19.”

The nth COVID peak

This year, with many countries battling the second or third COVID-19 wave, including Australia, is this pandemic no longer a true “black swan” risk event?

If organisations had a “technology regret” after the first COVID-19 wave, how about now?

The latest Deloitte’s report points out that many organisations (42%) are still in the respond phase, albeit COVID-19 helped organisations realise they need to up their third-party risk management game.

Another question is: Where does the responsibility fall? Is it with legal, industrial relations, risk, supply chain or procurement team, given third-party risk management has historically been siloed by risk domains or departmental walls?

Are you building in the dark?

We wouldn’t be solving the right problems without firstly asking the right questions.

That’s why since the beginning of this year, Felix have been speaking to industry leaders and immersed ourselves in the conversations around third-party risks.

We believe there are nuances worth exploring, issues worth discussing, and change worth effecting – particularly when we are all heading into an infrastructure-led recovery period.

We are in the process of producing a landmark piece of research paper, in collaboration with entwine – the research firm commissioned by Infrastructure New Zealand to produce “Creating Value in Procurement.”

Register your interest here and we will notify you once the report is published.

Related Articles

Report launch: Building in The Dark

Today marks the launch of the Building in the Dark report, which examines construction supply chain risk in Australia and New Zealand.

Top 10 reasons for a centralised vendor database

While some organisations still rely on multiple decentralised databases or spreadsheets to store vendor data, a centralised vendor database offers numerous advantages. This article explores the top 10 reasons why a centralised vendor database is more effective than having information scattered across multiple email inboxes and spreadsheets.

Let's stay in touch

Get the monthly dose of supply chain, procurement and technology insights with the Felix newsletter.