The year 2023 was a dynamic one for the construction and infrastructure sectors in Australia. While challenges like project cost blowouts and workforce shortages dominated headlines, there were also positive developments, including renewed investor interest and significant progress in sustainability. Let’s look back on the key themes that shaped the industry this year.

Infrastructure and construction in flux

Following the Independent Strategic Review of the Infrastructure Investment Program, 50 infrastructure projects were cancelled due to budget blowout. The review also estimated that the true cost of projects currently budgeted at $9 billion in 2027-28 actually surpassed $18 billion.

Down the chain, organisations have definitely felt the pinch. In FY22-23, 2,170 construction businesses have gone into administration, a 69% jump from 2021–22, and a 20% jump from the previous decade-high of 1,802 recorded in 2013–14.

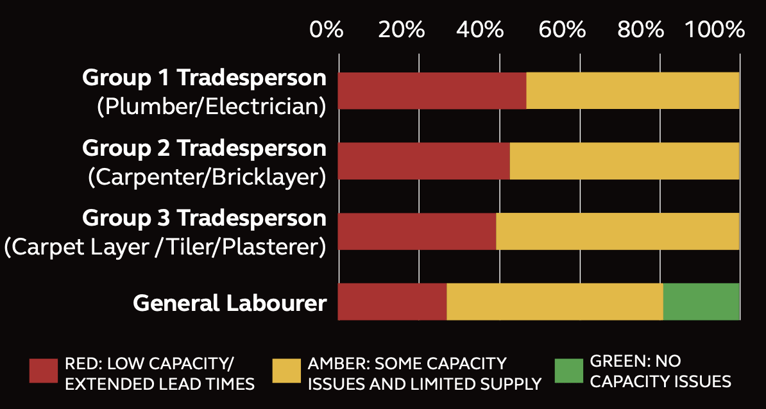

It’s no wonder 76% of respondents to the ACA 2023 Construction Market Sentiment Survey believe the current commercial environment unfairly burdens contractors with risk. While material price inflation shows signs of slowing, labour costs are skyrocketing. Over half of respondents reported severe constraints on trade labour capacity, a dramatic increase from 20% last year.

Source: ACA

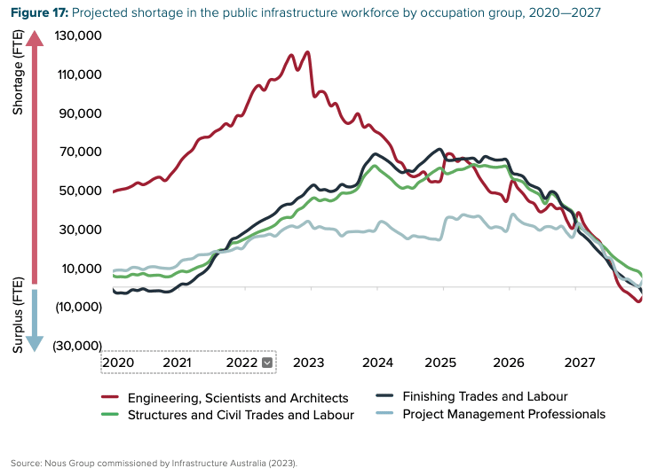

The most recent Market Capacity report from Infrastructure Australia highlights an impending shortage of 229,000 workers in the infrastructure sector. To address this, Australia's construction-related workforce must grow by 127% to meet the peak shortage expected in the middle of next year.

Adding to the labour challenges, regional and rural Australia now accounts for 48% of the pipeline by value according to Infrastructure Partnerships Australia. This means the labour demand for infrastructure workers in Outer Regional Australia is set to grow by over 150% by 2025.

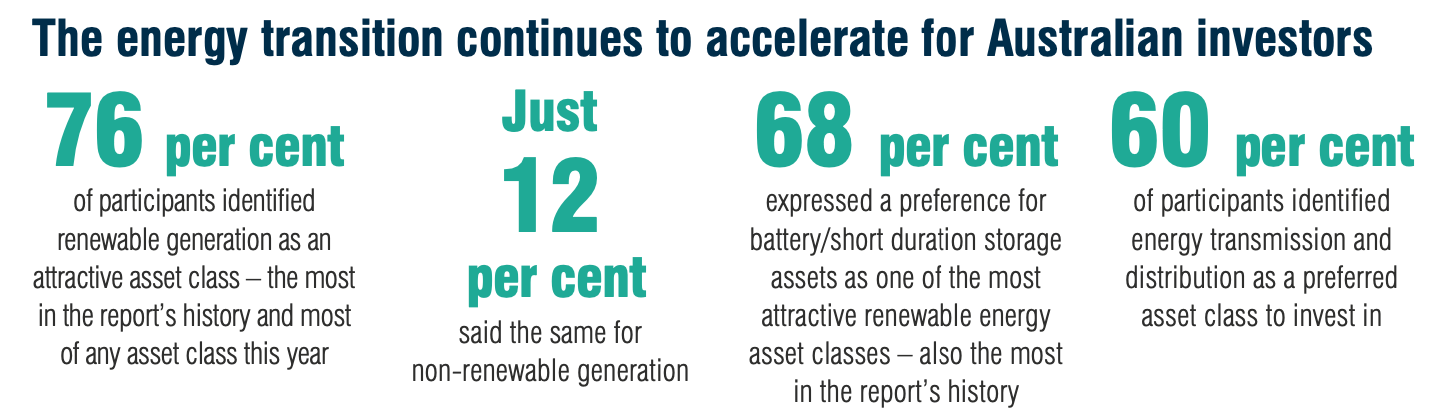

On a positive note, the eighth annual Australian Infrastructure Investment Monitor report indicates a resurgence in investor appetite within Australia's infrastructure market, reaching pre-pandemic levels, with 92% of participants ‘highly likely’ to invest. Renewable energy infrastructure investment also saw a record high in interest.

Source: Infrastructure Partnerships Australia

Source: Infrastructure Partnerships Australia

Another big change that took place was the passing of the Infrastructure Australia Amendment (Independent Review) Bill 2023. It’s hoped that the empowered IA would mean infrastructure decisions are made in the best interests of the country, rather than being influenced by political considerations.

Sustainability

The Government has proposed mandatory climate-related reporting which could start as early as July next year. Here are some other movements signifying traction in terms of sustainability and ESG this year.

In August, Infrastructure Net Zero was launched by seven private sector peak bodies and three federal government agencies.

The initiative brings together the infrastructure sector’s key stakeholders to:

- agree on common goals and sectoral targets

- align on the pathways to achievement

- co-ordinate and collaborate on action

- monitor and report on progress

NSW's landmark Climate Change (Net Zero Future) bill has passed, mandating a 50% emissions reduction by 2030 and net zero by 2050. A strong, independent Net Zero Commission will monitor progress and hold the government accountable.

Check out our article on Net Zero targets state-by-state.

Green Star certifications soared by over 80% in the 2022-23 financial year, reaching an all-time high of over 800 certifications issued across Australia. This is a testament to the growing commitment to sustainability within the built environment.

A host of guides was launched or updated:

- The guide On Track to a Sustainable Future– Australasian Railway Association Sustainability Guide — launched at ARA’s major conference AusRAIL PLUS 2023, offers practical solutions for small-to-medium businesses in the rail industry.

- The Green Building Council of Australia (GBCA) and the Property Council of Australia have unveiled a new report outlining a comprehensive set of recommendations for local governments to reduce carbon emissions in buildings.

- The revised PAS 2080 expands its scope, emphasises whole-life carbon, and aligns with net zero goals, offering a stronger roadmap for sustainable construction.

At the recent COP28 climate summit, 50 major oil and gas companies, including 29 state-owned giants, signed the Global Decarbonization Charter (OGDC). This monumental agreement marks a significant step forward in tackling climate change within the industry.

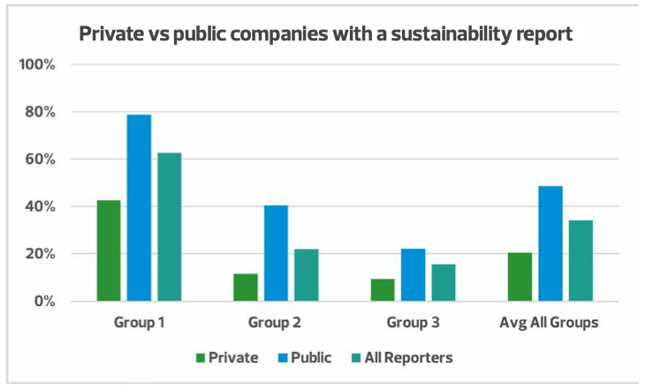

However, a recent report by RSM, "From Sustainability Marketing to Sustainability Accounting: How Prepared is Corporate Australia for Mandatory Climate Reporting?", reveals that less than half (40%) of Australian companies publish sustainability reports.

Source: RSM

Source: RSM

The report further exposes a disparity between private and public companies, with only 20% of private companies publishing reports compared to 50% of public companies. Additionally, industries like mining, financial services, and energy demonstrate more advanced sustainability reporting practices than sectors like construction, retail, and agriculture.

Given the growing importance of Net Zero and ESG more broadly, Felix is proud to have been a part of organisations’ journey from a technology standpoint.

As an example, Felix is excited to aid Fulton Hogan's Reconciliation Action Plan journey by making it more seamless to identify and track opportunities in their supply chain, and increase visibility of subcontractor's Indigenous procurement policies.

In addition, we’re seeing more and more clients using Felix’s vendor management module to capture Net Zero related insights from their supply chain.

Picture taken at Fulton Hogan's Project Leaders Forum in Sydney

Picture taken at Fulton Hogan's Project Leaders Forum in Sydney

Cybersecurity

A recent cyber pulse survey by ASIC reveals that 44% of organisations do not manage third party or supply chain risk.

This comes in the wake of a significant cybersecurity incident at DP World – Australia’s biggest ports operator - and stricter cybersecurity reporting requirements for telcos. The situation underscores the importance of not just focusing on security but also building resilience, which refers to the ability to respond to and recover from an incident.

At Felix, the security and confidentiality of customer and vendor data has always been a top priority. This year, we are thrilled to be SOC 2 (Type 1) certified and GDPR compliant. SOC 2 and GDPR represents a high standard that is globally recognised to demonstrate our commitment to securing our customers critical information assets.

Product improvements

In 2023, we onboarded several mining customers among 14 client implementations. Meanwhile, the team diligently enhanced the Felix platform through 300+ product releases.

Some of Felix’s notable feature releases include:

- Update RFQ responses on a vendor’s behalf

- See reasoning behind scores when comparing RFQ evaluations

- Instant ABN verification when vendors onboard

- Expired or invalid ABNs flagged in the Vendor List

- Customer-facing roadmap

- AI-powered compliance document recognition

Platform growth

This year's progress is reflected in the positive statistics, highlighting the impact of our efforts:

- 69.5% increase in total vendors (across 86 countries)

- 66.5% increase in vendor invitations

- 64.6% increase in RFQs created

- 32.7% increase in vendor evaluations performed

- 43.7% increase in vendor tags

- 49.5% increase in value of projects awarded through Felix

Partnership

This year, we've joined forces with Eftsure as a strategic partner with a native platform integration for Eftsure’s Fraud warnings.

Final words

As productivity goes backwards or remains stagnant for many industries including construction and mining, it’s time to seriously think about ways of working smarter. Particularly when more compliance requirements (e.g. Net Zero) are on the horizon, meaning more will be on everyone’s plate.

As we move forward, Felix remains dedicated to supporting organisations in their journey towards a more sustainable and secure future.

We wish you all the very best for the holidays and let’s reconnect in the new year!

----

The majority of the Felix team will be out of office from Thursday December 21st and return Monday January 8th. Need Product Support over the break? Our team will be available Monday – Friday 7am – 7pm AEST excluding the following public holidays.

- Monday 25/12/2023: Closed

- Tuesday 26/12/2023: Closed

- Monday 01/01/2024: Closed

Related Articles

.png)

2022 Year Review: Felix's 10-year milestone

This year has been eventful to say the least. We published a landmark report, celebrated Felix’s 10-year journey, and witnessed tremendous ups and downs across the industry. Let’s go through the highlights.

Webinar recap: Why vendor management matters

Industry participants agreed that it’s not getting easier to source suitable third parties, according to the Building in The Dark report. In fact, 67% believed this process to be highly variable or very challenging.

2021 Year Review: Felix's first year as FLX

We started out 2021 with a bang, being the first ASX tech listing of the year. And while operating as a publicly listed company has been something new for Felix, our mission to build a better way has remained unchanged.

Let's stay in touch

Get the monthly dose of supply chain, procurement and technology insights with the Felix newsletter.