With so many compliance topics that organisations need to keep track of, it can be even more overwhelming as requirements also differ by state. Whether you're a supplier to the government, or a supplier of a supplier, it's good to have awareness, especially when regulations change over time.

In this post, we attempt to display various policies of note, including ESG-focused procurement targets across the states in Australia side-by-side (last update: June 2024).

- Industrial Manslaughter

- Project/Retention Trust Account

- Indigenous procurement

- Local content/ Industry Participation

- Small Medium Enterprise

Want to download the list (plus more) in a PDF for reference later? Click here

Industrial Manslaughter

|

State |

Effective date |

Offence description |

Fines for non-compliance |

|

ACT |

Introduced in 2004, amended in 2021 |

A person conducting a business or undertaking (PCBU) or an officer of a PCBU commits industrial manslaughter if they engage in conduct which breaches a health and safety duty and causes a person's death. The PCBU or officer must have been reckless or negligent about causing the death. |

Maximum 20 years' imprisonment for an individual and $16.5 million for a company |

|

VIC |

2020 |

This applies to employers, self-employed people and ‘officers’ of the company or organisation and will also apply when an employer’s negligent conduct at a workplace causes the death of a non-employee. |

Maximum 25 years' imprisonment for an individual and $18.17 million for a company |

|

NSW |

The gov. to introduce a bill to parliament in June 2024 |

|

Maximum penalty of 25 years jail for an individual or $20 million in fines for a body corporate |

|

QLD |

2017 |

It applies when a PCBU or senior officer to negligently cause the death of a worker, including where a worker is injured carrying out work and later dies. |

Maximum 20 years' imprisonment for an individual and $10 million for a company |

|

WA |

2022 |

A duty holder (including officers of PCBUs in some situations) fails to comply with their health and safety duty and engages in conduct that causes the death of an individual, in the knowledge that the conduct was likely to result in death or serious harm, and in disregard of that likelihood. |

Maximum 20 years' imprisonment and a fine of $5 million for an individual and $10 million for a company |

|

NT |

2020 |

A duty holder, a PCBU or an officer of a PCBU, intentionally engages in conduct that breaches their health and safety duty and causes the death of an individual to whom that duty was owed, and is reckless or negligent about the conduct breaching their safety duty |

Maximum life imprisonment for an individual or $10,076,000 |

|

SA |

2024 |

A person conducting a business or undertaking (PCBU) or an officer of a PCBU has been either reckless or grossly negligent in conduct which breaches a work health and safety duty under the Work Health and Safety Act 2012 (WHS Act) and which results in the death of an individual. |

Maximum penalty of 20 years imprisonment for an individual or $18 million for a company |

|

TAS |

|

Not currently an offence |

|

So far, the only prosecution in Australia for industrial manslaughter of a body corporate was that of Brisbane Auto Recyclers in June 2020. The company was fined $3 million, and its directors sentenced to 10 months’ imprisonment.

In March 2022, Jeffrey Owen, the owner of Owen’s Electric Rewinds, became the first individual charged, prosecuted, and convicted of industrial manslaughter in Queensland.

> Back to topProject / Retention Trust Account

|

State |

Effective date |

Applicable to |

Description |

Fines for non-compliance |

|

ACT |

N/A |

N/A |

N/A |

N/A |

|

VIC |

N/A |

N/A |

N/A |

N/A |

|

NSW |

2015 |

Projects valued over $20 million |

Retention money held by head contractors must be held in a trust account with an authorised deposit taking institution. Usually up to 5% of the total contract value is held by the head contractor until the subcontractor has completed the job and fixed any defective work. A head contractor must keep records in the form of a ledger, to be provided to the subcontractor at least once every 3 months, or as often as may be agreed in writing. |

Fines of up to $22,000 |

|

QLD |

First phase began in March 2021, final phase to start October 2025 |

All eligible building and construction contracts valued at $1 million or more (state/local government, hospital and health, private) |

One project trust account to be established for each eligible contract One retention trust account per contractor to hold all cash retentions for contracts under a project trust account project. Those managing a retention trust account must attend retention trust training. For each project trust account and retention trust account, a separate and individual account ledger must be kept. All trust records must be retained for at least 7 years. |

• fines of up to 200 penalty units • one year’s imprisonment • being reported to ASIC • being reported to their professional accounting body for disciplinary action. |

|

WA |

Phase 1: from Feb 2023 to end of Jan 2024 Phase 2: from Feb 2024 onwards |

Retention Trust Scheme applies to: Construction contracts over $1 million except:

In phase 2, the contract value is $20,000 or more. |

Retention money held or withheld under a construction contract (above a certain threshold) will be held on trust for the benefit of the party who provided the money. The retention money must be deposited into a retention money trust account established with a recognised financial institution. Retention money will often represent a large proportion (if not all) of the profit on a project. |

An individual will face a fine of $50,000 for non-compliance, whereas a body corporate faces a fine of $250,000. |

|

SA |

N/A |

N/A |

N/A |

N/A |

|

TAS |

N/A |

N/A |

N/A |

N/A |

> Back to top

Indigenous (Aboriginal) Procurement Policy

|

State |

Effective date |

Target |

Reporting/Enforcement |

|

ACT |

Launched on 31 May 2019

|

Applies to projects over $5 million:

|

Government agencies are required to:

Underperforming entities may be required to deliver a plan to higher authorities explaining the reasons and outlining improvement. |

|

VIC |

April 2018

|

A general target of 1% of government procurement from SME to be from Aboriginal businesses, plus some recommended actions:

|

Government entities are required to: · report on their social procurement activities under the SPF in their own Annual Reports · contribute to an annual whole of Victorian Government report on aggregated SPF outcomes and benefits To measure and report on these aims, suppliers can capture:

|

|

NSW |

1 January 2021 |

The Aboriginal Procurement Policy (APP) was merged with the Aboriginal Participation in Construction Policy.

For all contracts valued at $7.5 million or above, agencies must include minimum requirements for 1.5% Aboriginal participation by requiring one or a combination of the following:

|

Suppliers must:

|

|

QLD |

1 September 2017 |

Target: 3% of the value of government procurement contracts to be awarded to Indigenous businesses by 2022. This applies to all Queensland budget sector agencies. It does not apply to Queensland Government owned corporations or the Queensland statutory bodies. |

Each government agency will report on:

|

|

WA |

Introduced on 1 July 2018 |

Agency contracting targets

Aboriginal participation requirements for suppliers

All contracts valued at $5M+ in the following industries: construction and maintenance, community and social services, education and training, public administration and finance services also need to meet one of two requirements below:

|

The Department of Finance is responsible for:

A State agency is responsible for:

Suppliers are responsible for:

|

|

NT |

From 1 July 2022

|

Applies to contracts over $15,000: FY 2022-23:

|

Government agencies are required to report annually against the Aboriginal Procurement Policy targets in:

|

|

SA |

Part of the Industry Participation Policy effective from July 2021 |

Contracts above $220,000: Government agencies may apply an Industry Participation plan and increase the industry participation weighting above the minimum 15%. |

|

Interested in learning more about ESG compliance requirements? We hosted a webinar with experts from Sparke Helmore.

Local Content (Industry Participation)

|

State |

Relevant policy name |

Requirements |

Reporting/Compliance |

|

ACT |

Canberra Region Local Industry Participation Policy (LIPP) |

• Contract value between $25,000 and $200,000: min. 3 written quotes where 1 must be sought from a local business and 1 from an SME. • Contract value > $200,000 and under $5M: an Economic Contribution Test (ECT) must be submitted, which weighs 10% in the evaluation process • Contract value $5M or more: a local IP Plan is required, which weighs 10% in the evaluation process Both the ECT and IP Plan require details around how the bidder intends to contribute to the local economy through supply chain or local subcontractors. |

For contract value $5 or more, reporting on Local IP Plan outcomes will be a contractual obligation for successful respondents throughout the duration of their contract. Failure of contractors to comply, in part or in whole, with the LIPP and the commitments in their Local IP Plans will be a factor that will be taken into account in the award of future contracts by the ACT Government. Provision of Local IP Plan reports will be a condition for final payment on contracts. |

|

VIC |

The Local Jobs First Policy is comprised of the Victorian Industry Participation Policy (VIPP) and the Major Projects Skills Guarantee (MPSG) |

The responsible Minister must set local content and other requirements for Strategic Projects at no less than:

Two minimum weightings to be applied in evaluating tenders for all Local Jobs First projects:

The Major Projects Skills Guarantee (MPSG) applies to projects that are construction projects with a budget of $20 million or more. The MPSG may apply to both Standard and Strategic projects. All tenders, proposals or other submissions for a Local Jobs First project must submit an Industry Capability Network (ICN)-certified Local Industry Development Plan (LIDP). |

Contractors are responsible for ongoing monitoring of the application of Local Industry Development Plan commitments by themselves and their supply chain. Evidence must be retained appropriately to demonstrate compliance with Local Jobs First. The delivery agency, DJPR and the Local Jobs First Commissioner may request information during and after a project to evaluate Local Jobs First compliance. Post contract verification starts on practical completion of the project when works have been completed.

|

|

NSW |

Small and Medium Enterprise and Regional Procurement Policy

|

Procurements over $3 million must have a local participation plan. For Construction projects between $10 - $100 million:

For major construction projects over $100 million:

|

Suppliers to provide quarterly reports to Training Services NSW in the Department of Education against agreed targets. |

|

QLD |

Queensland Charter for Local Content

|

Applicable projects:·

While there are no specific targets, government agencies are required to demonstrate local content opportunities via various mechanisms, e.g. Forward Procurement Plans, Statement of Intent, Project Outcome Report. |

An annual review of local content in government procurement will be undertaken by the department. Local content reporting requirements are placed in contracts. In addressing the Statement of Intent (SOI), tenderers should outline how they will ensure reporting requirements will be passed on to subcontractors. |

|

WA |

Buy Local Policy – WA Industry Participation Strategy (WAIPS) – Priority Start policy |

A participation plan is required for projects:

Plans are weighted at either 10% or 20% of the qualitative evaluation for both the core and full participation plans. Projects of $25 million or more deemed strategic will require a participation plan with additional local commitments. For contracts below these thresholds the WA Government’s procurement policies and the WA Buy Local Policy 2022 will apply. --- State Government agencies issuing building, construction and maintenance contract and the head contractor and subcontractors used for the contracts are in scope of the Priority Start policy.

|

For contracts greater than 12 months, suppliers are required to provide:

For contracts less than 12 months, suppliers only need to provide the procuring agency with a Final Plan Implementation Report within 2 months of practical completion of the contract. If the reported outcomes vary significantly from the commitments in the contract, suppliers may be required to provide an explanation. If no valid reason can be identified, the procuring agency may determine that this represents breach of contract. The Minister for State Development, Jobs and Trade may request audits to make sure that successful suppliers have met their local participation obligations. --- For the duration of the contract, head contractors must meet the target training rate and submit a Priority Start report for each 12-month reporting period and at the end of the contract. For audit purposes, head contractors are required to keep supporting information used to calculate the following for a minimum of two years from contract completion. Non-compliance will be treated as a breach of contract. Similar reporting requirements apply to subcontractors as well. |

|

SA |

South Australian Industry Participation Policy (IPP)

|

Procurements up to and including $55,000 but below $550,000:

Procurements over $550,000 but below $10 million:

Procurement above $10 million but below $50 million:

Procurements of $50 million and over:

Direct Negotiation

Panel Contracts

Private Sector and University Projects receiving Significant Monetary Support or Value-in-kind equal to or above $2,500,000

|

Tenderers are required to submit IP Plan report to Office of the Industry Advocate and the responsible government agency in line with contract conditions. They also need to ensure IP Plan Reports are submitted to the public authority and copy provided to the Office of the Industry Advocate (OIA), in accordance with the required reporting frequency. |

|

NT |

Buy Local Plan and Territory Benefit Policy |

Agencies must allocate a minimum weighting of 30% to the local content test criteria. For all tier 1 and 2 procurements conducted through a simplified quotation process, rather than through a public tender process, agencies need to invite at least one quote from a Territory enterprise. A Territory Benefit Plan (TBP) will be a requirement for:

|

The Buy Local Industry Advocate is an independent link between local business and the NT Government:

TBPs must detail the methods that will be used to communicate key commitments made in, and report on the outcomes achieved by, the Territory Benefit Plan to identified stakeholders (including the public, local industry and NT Government). |

|

TAS |

Buy Local Policy |

For roads and bridges works procurement processes valued at $500 000 or more; and all other procurement processes valued at $250 000 or more:

For all competitive procurement processes valued at $100 000 or more:

A Tasmanian Industry Participation Plan (TIPP) is required for:

|

TIPPs must be approved by the Accountable Authority before the contract, funding agreement or grant deed is finalised and before the supplier, project proponent or grantee enters into sub-contracting or procurement arrangements in relation to the project. All Tasmanian Industry Participation Plans (or an executive summary of the Plan) developed between agencies and successful suppliers will be published on the Purchasing website.

|

> Back to top

Small and Medium Enterprises (SMEs)

|

State |

Relevant policy name |

Targets/Requirements |

Reporting/Compliance |

|

ACT |

N/A |

Bundled with the Local Industry Participation policy. |

N/A |

|

VIC |

N/A |

No specific target but in the required Industry Participation Plan, suppliers need to include the number of SMEs to be engaged as part of the contract. |

N/A |

|

NSW |

SME and Regional Procurement Policy and Small Business Shorter Payment Terms Policy |

NSW Government agencies must first consider purchasing from an SME, for procurements up to $3 million. For contracts valued at $3 million or more:

Large businesses with NSW Government contracts valued at $7.5 million or above will be required to pay small business subcontractors within 20 business days. |

Large businesses have to report on:

Large businesses must report twice per financial year. |

|

QLD |

Queensland Procurement Policy |

Sourcing at least 25% of procurement by value from QLD SMEs, increasing to 30% by June 2022. |

The target is set at an aggregate level across all Queensland Government procurement categories. Each agency is accountable for contributing to meeting the aggregate target, and complying with reporting requirements. |

|

WA |

N/A |

Bundled with the Local Industry Participation policy. |

N/A |

|

SA |

N/A |

Refer to the above section on Industry Participation. |

N/A |

|

NT |

N/A |

N/A |

N/A |

|

TAS |

N/A |

N/A |

N/A |

Interested in seeing how Felix can help you meet your ESG mandate? Learn more here.

For a more detailed list of ESG and procurement requirements, click here to download the PDF version.

Related Articles

Project procurement vs. Category management for principal contractors

Procurement and supply chain management can be incredibly complex and critical for project success, especially in construction – where there are layers of subcontracting parties.

How social procurement is much more than corporate social responsibility

Are you leveraging social enterprises in your tenders? Because your competitors are. There's a growing expectation for contractors to include social enterprises when bidding and delivering commercial and major government projects, yet navigating social procurement remains an afterthought for many.

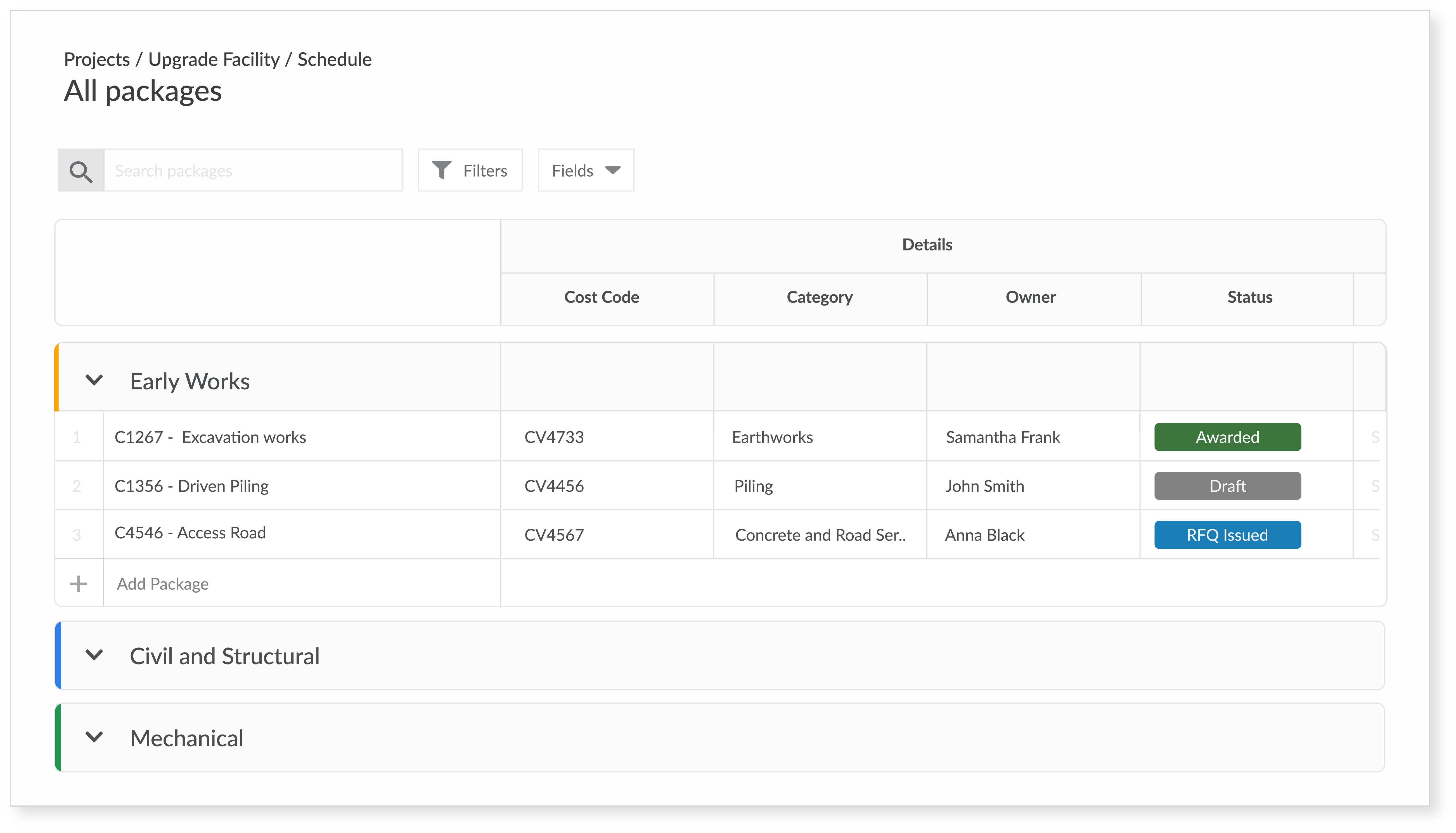

Webinar recap: Introducing Procurement Schedule

Recently, I had the pleasure of unveiling our latest module Procurement Schedule in our launch webinar. Below are the highlights of the session.

Let's stay in touch

Get the monthly dose of supply chain, procurement and technology insights with the Felix newsletter.